Purchasing items with discounts is a common transaction in business. In TallyPrime, you can enter purchase transactions while applying discounts on individual items. Discount is a reduction in the price of an item or total invoice amount.

In TallyPrime, you can apply discounts in several ways: Discount entry in TallyPrime refers to recording purchases/ sales where a discount is applied to items or invoice. Businesses use discounts to attract customers or to get benefits from suppliers.

Types of Discount in TallyPrime

| Type of Discount | Applied On | Where to Use |

| 50% Discount | On item rate (percentage) | In the discount column during item entry |

| Flat Discount | On item or total | Reduce item rate manually or use discount column |

| Discount on Full Bill | On total invoice amount | Use ledger like “Discount Allowed” after item entry |

50% Discount in TallyPrime

% Discount on Rate” means the discount is calculated as a percentage of the item’s rate and subtracted from it before calculating the final amount. A 50% discount means half the price of a product is deducted before the customer pays. It’s a percentage-based reduction applied on the selling price or MRP.

Example 1: 50% Discount on Rate

| Item | Quantity | Rate | Discount | Amount |

| Smartphone | 2 Nos | ₹15,000 | 50% | ₹15,000 |

Explanation:

- Rate = ₹15,000, Quantity = 2

- Total before discount = ₹30,000

- 50% discount = ₹15,000

- Final amount = ₹15,000

Flat Discount ₹50 Per Item

A Flat Discount means a fixed amount is reduced from the total bill or item price — not based on percentage. It is a straight ₹-value deduction, such as ₹50 or ₹500 off, regardless of the original price.

| Item | Quantity | Rate | Discount | Amount |

| Laptop | 1 Nos | ₹40,000 | ₹50 | ₹39,950 |

Explanation:

Flat ₹50 discount given on one laptop.

₹50 Total Discount on Full Bill

Discount on Total” (also called Invoice-level Discount or Full Bill Discount) means a fixed amount or a percentage is applied to the entire invoice amount, not on individual items.

| Item | Quantity | Rate | Discount | Amount |

| Smartphone | 1 Nos | ₹15,000 | – | ₹15,000 |

| Laptop | 1 Nos | ₹40,000 | – | ₹40,000 |

| Flat Discount | – | – | ₹50 (on total) | ₹(50) |

| Total | ₹54,950 |

Explanation:

No item-wise discount — instead, ₹50 discount applied to total bill using a Discount Allowed ledger.

How to record Item-wise Discount Purchase / Sales Entry in TallyPrime

TallyPrime is a comprehensive accounting tool that makes it easy to handle invoices, manage stock, and track payments. One feature that many users look for is adding a discount column in their invoices. Discounts are an integral part of sales and purchase transactions, and TallyPrime provides an easy way to handle them.

How to Enable Item-Wise Discount Column

- Go to Gateway of Tally → F11 (Features) → Inventory Features

- Set Use Separate Discount Column in Invoices to Yes

- Press Ctrl + A to save

Create Part Ledger

go to Vouchers

Item-wise Discount

- Go to Vouchers → Sales (F8) or Purchase (F9)

- Select Party Name

- Enter stock items one by one

- In the Discount column, enter discount percentage for each item

Example: 10%

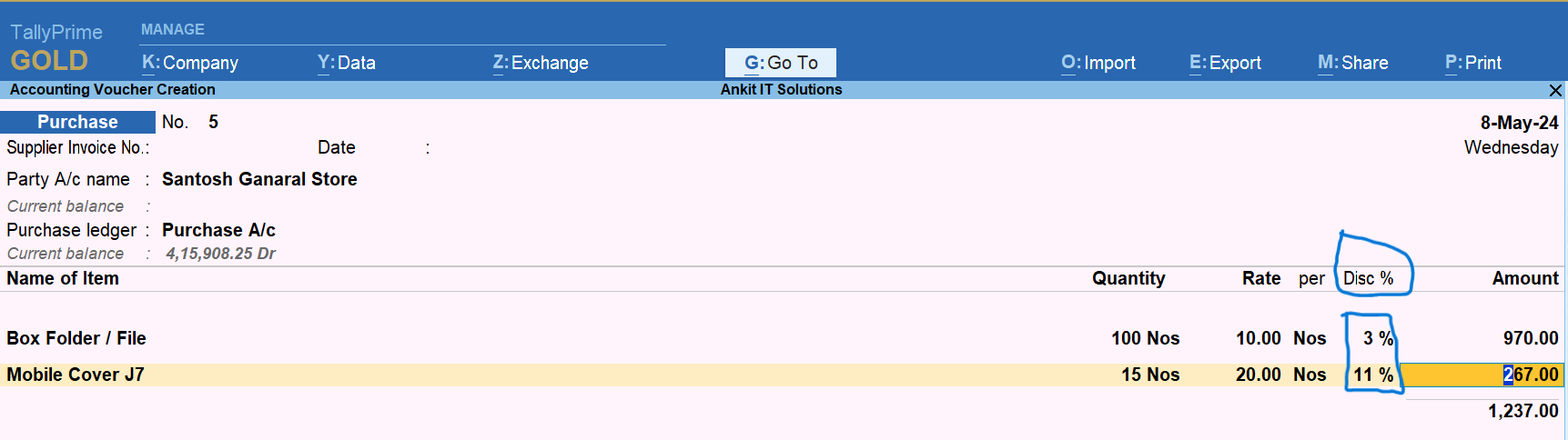

Purchase Voucher with Discount Column – Item wise Discount Purchase Entry in TallyPrime

Sales Voucher with Discount Column – Item wise Discount Purchase Entry in TallyPrime

Invoice-Level (Total) Discount

- Create a Discount Ledger:

- Go to Accounts Info → Ledgers → Create

- Name: Discount

- Under: Indirect Expenses (for sales discount) OR Indirect Incomes (for purchase discount)

- Type of Ledger: Sales or Purchase

- In the invoice, after item entry, add Discount ledger manually

- Enter the discount amount directly (like ₹500)

Method 2

Assignments

I. Percentage Discount on Items (Different Rates)

This discount is applied individually on each item in the sales voucher by enabling the discount column.

Assignment 1 – Smartphone with 30% Discount

| Item | Qty | Rate | Discount | Final Amount |

| Smartphone | 2 Nos | ₹15,000 | 30% | ₹21,000 |

Task:

- Enable “Use Separate Discount Column” in F11 (Inventory Features).

- In Sales voucher, enter Smartphone (2 Nos @ ₹15,000).

- Apply 30% discount, so the total becomes ₹21,000.

Assignment 2 – Laptop with 10% Discount

| Item | Qty | Rate | Discount | Final Amount |

| Laptop | 1 Nos | ₹40,000 | 10% | ₹36,000 |

Task:

- Enter laptop @ ₹40,000.

- Apply 10% discount → Final = ₹36,000.

Assignment 3 – Tablet with 20% Discount

| Item | Qty | Rate | Discount | Final Amount |

| Tablet | 4 Nos | ₹10,000 | 20% | ₹32,000 |

Task:

- Record 4 Tablets @ ₹10,000.

- Apply 20% off on each → ₹8,000 per unit → Final total = ₹32,000.

2. Flat Discount (Fixed ₹ Value Off)

This discount is applied on the individual item or total invoice by reducing a fixed amount from the original price.

Assignment 1 – Laptop with ₹2,000 Flat Discount

| Item | Qty | Rate | Flat Discount | Final Amount |

| Laptop | 1 Nos | ₹40,000 | ₹2,000 | ₹38,000 |

Task:

- Enter laptop @ ₹40,000.

- Apply flat ₹2,000 discount → Final = ₹38,000.

Assignment 2 – Smartphone with ₹1,500 Flat Discount

| Item | Qty | Rate | Flat Discount | Final Amount |

| Smartphone | 2 Nos | ₹15,000 | ₹1,500 | ₹28,500 |

Task:

- Enter smartphone (2 Nos @ ₹15,000).

- Apply flat ₹1,500 discount per unit → Final total = ₹28,500.

Assignment 3 – Tablet with ₹500 Flat Discount

| Item | Qty | Rate | Flat Discount | Final Amount |

| Tablet | 4 Nos | ₹10,000 | ₹500 | ₹38,000 |

Task:

- Record 4 Tablets @ ₹10,000.

- Apply flat ₹500 discount on each unit → Final total = ₹38,000.

3. Discount on Full Bill (Invoice-level Discount)

This discount is applied to the entire invoice after all items have been entered, providing a fixed discount on the total bill amount.

Assignment 1 – Laptop and Smartphone with ₹2,000 Invoice-Level Discount

| Item | Qty | Rate | Total Item Amount |

| Laptop | 1 Nos | ₹40,000 | ₹40,000 |

| Smartphone | 2 Nos | ₹15,000 | ₹30,000 |

| Total | ₹70,000 | ||

| Invoice Discount | ₹2,000 | ||

| Final Amount | ₹68,000 |

Task:

- Enter items: Laptop (₹40,000) and Smartphone (₹30,000).

- Apply ₹2,000 invoice-level discount after entering the items.

- The final amount becomes ₹68,000 after the discount is applied.

Assignment 2 – Tablet and Monitor with ₹1,000 Invoice-Level Discount

| Item | Qty | Rate | Total Item Amount |

| Tablet | 3 Nos | ₹10,000 | ₹30,000 |

| Monitor | 2 Nos | ₹8,000 | ₹16,000 |

| Total | ₹46,000 | ||

| Invoice Discount | ₹1,000 | ||

| Final Amount | ₹45,000 |

Task:

- Enter items: Tablet (₹30,000) and Monitor (₹16,000).

- Apply ₹1,000 invoice-level discount after entering the items.

- The final amount becomes ₹45,000 after applying the discount.

Assignment 3 – Smartphone, Laptop, and Tablet with ₹3,000 Invoice-Level Discount

| Item | Qty | Rate | Total Item Amount |

| Smartphone | 2 Nos | ₹15,000 | ₹30,000 |

| Laptop | 1 Nos | ₹40,000 | ₹40,000 |

| Tablet | 2 Nos | ₹10,000 | ₹20,000 |

| Total | ₹90,000 | ||

| Invoice Discount | ₹3,000 | ||

| Final Amount | ₹87,000 |

Task:

- Enter items: Smartphone (₹30,000), Laptop (₹40,000), and Tablet (₹20,000).

- Apply ₹3,000 invoice-level discount after entering all items.

- The final amount becomes ₹87,000 after the discount is applied.