Bank Reconciliation Statement also known as BRS. Bank reconciliation is a process of matching entries (e.g. customer payments, receipt, bank fees etc.) on the company’s tally books with the corresponding data on its bank statements. Using BRS companies can confirm that the company’s records are correct or not.

Bank reconciliation is a vital accounting process for businesses of all sizes. It ensures that the company’s financial records match the bank’s records and helps in identifying any discrepancies.

Bank reconciliation is crucial for several reasons:

- Ensures Accuracy: Helps confirm that your cash flow records match with the bank’s statements.

- Identifies Discrepancies: Highlights any missing transactions or errors in your records or the bank’s.

- Improves Financial Management: Helps detect fraudulent transactions, incorrect payments, or bank charges that may have been overlooked.

- Legal Compliance: Ensures that your business maintains transparency and accurate financial reporting.

By regularly reconciling your bank accounts, you ensure that your business finances are in check, and you can trust the accuracy of your financial statements.

How to Perform Bank Reconciliation in TallyPrime

TallyPrime streamlines the entire reconciliation process, making it easy to reconcile your bank accounts. Follow these simple steps:

Set up Bank Accounts in TallyPrime

Before you start with reconciliation, ensure that the bank accounts are correctly configured in TallyPrime.

- Open TallyPrime click on create

- Under Ledgers, select Create to add a new ledger.

- Select the Bank Accounts group.

- Enter the bank account name (e.g., HDFC Bank Current Account).

- Fill in the bank account details, such as account number, branch name, and IFSC code.

- Save the ledger.

Repeat these steps for all the bank accounts you want to reconcile.

Record Bank Transactions

Ensure all bank transactions such as deposits, withdrawals, and payments have been recorded in TallyPrime. This can be done through Vouchers like Payment, Receipt, and Contra.

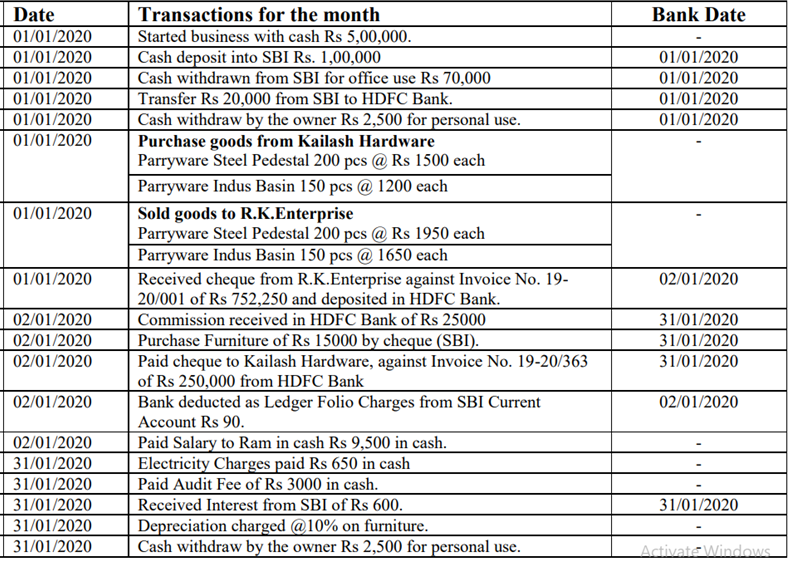

Record the following transactions in the books of M/s ABC Limited and prepare Bank Reconciliation Statement for the month of January 2020:

- Go to the Gateway of Tally and select Vouchers.

- Choose the appropriate voucher type:

- Payment Voucher for payments made from the bank.

- Receipt Voucher for receipts credited to the bank.

- Contra Voucher for bank transfers between different accounts.

Make sure to enter the correct date, amount, and corresponding bank ledger while recording the transactions.

Step 3: Open the Bank Reconciliation Screen

Once all the transactions are recorded, it’s time to reconcile the bank account.

- Go to the Gateway of Tally.

- Select Banking and then choose Bank Reconciliation.

- A list of bank accounts will be displayed. Select the bank account you wish to reconcile.

Step 4: Adjust and Resolve Discrepancies

In case there are discrepancies between the bank’s records and TallyPrime entries, you’ll need to resolve them.

- If there are bank charges, interest, or any other fees that have been recorded in the bank statement but not in your Tally account, create a voucher to record them.

- Similarly, if there are deposits or withdrawals that haven’t been entered in Tally, you need to record them.

You can use the F5 (Payment) and F6 (Receipt) buttons to add those missing entries.

To review, go to Banking> Statements of Accounts > Bank Reconciliation. This will show you a detailed report of all reconciled and unmatched transactions.

By completing this assignment, you will gain hands-on experience in performing bank reconciliation in TallyPrime, which is a fundamental skill in financial management. You will also understand how to identify and resolve discrepancies between the business’s accounting records and the bank statement.