Interest calculation in TallyPrime means calculating interest automatically on outstanding receivables or payables (like overdue invoices, loans, advances).

Interest can be calculated on the basis of Simple or Compound Interest , In TallyPrime, you can calculate Simple Interest easily, which is one of the simplest methods for interest calculation.

You can calculate interest:

- Party-wise (Customer/Supplier)

- Voucher-wise (Individual invoice)

- Automatically or manually

Enable Interest Calculation in TallyPrime

- Go to: Gateway of Tally → Press F11 (Features)

- Enable: Accounting Features

- Set “Activate Interest Calculation” to Yes

- Press Ctrl + A to save

Step 1 Enable Interest Calculation Features In Tally Prime by Pressing F11 Key.

Required Following Details

- Party A/c under Sundry Creditors / Debtors

- Purchase A/c under Purchase Accounts

- Interest Paid under indirect Expense

Step 2 How to Create a Party Ledger with Interest Parameters

- Gateway of Tally → Create → Ledgers

- Name: ABC Traders /Advantech Computer

- Under: Sundry Debtors or Sundry Creditors

- Maintain Balances Bill-by-Bill: Yes

- Set “Activate Interest Calculation”: Yes

Create / Alter A Ledger and Enable Activate interest calculation.

Step 3 Set Interest Parameters:

- Calculate Interest Transaction-by-Transaction: Yes

- Override Parameters for Each Transaction: Yes/No (Your choice)

- Interest Rate: e.g., 10%

- Style of Calculation: calender year or 30-day month

- Interest Type: Simple (or Compound if required)

In this Tutorial Suppose Interest Will Apply 10% Yearly After Payment Due Date When Any Party Crossed His Payment Date, Then We will Charge @ 10% Yearly as Interest or (According to your Companies / Farm Rules).

Important Interest Terms

| Term | Meaning |

| Rate of Interest | The % rate applied annually (e.g., 12%) |

| From Due Date | Interest will start after the credit period |

| Override Parameters | You can change interest for each invoice at voucher level |

| Style of Calculation | Based on 365-day year or 30-day month style |

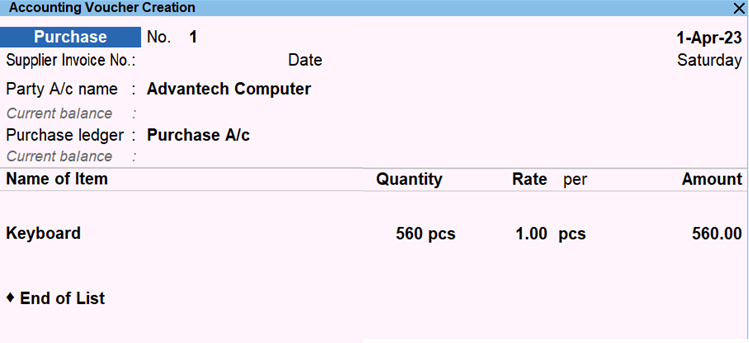

Step 4 Company Purchase Following Item on Credit 30 days – Purchase Voucher

Voucher Entries

- 1Apr- 2023 – Laptop 2 Nos @43000 from ABC Traders on Credit

- Credit Days 30

- Due Date 01-05-23

- 2Nov- 23 -Credit Note – Interest Paid

- Make Full Payment

Step 5 Due Date or Credit Days Setup (30 Days) – according to your requirement

How to View Interest Reports

Go to:

GOT >> Display More Report >> Statement of Account >> >> Interest Calculation >> Interest Payable >> F2 > Choose Period

Company didn’t pay their amount till 02-11-23 due any reason , so here interest will be applied.

See Interest Report

Interest Report

Credit Note Voucher

Pass Credit Note Voucher (ALT + F6) of Interest Amount to Party Account

- Credit Note Voucher Date – 02-11-23

- Voucher Mode – Interest Accounting

- Ledger Name Interest Paid Under Indirect Expense

Ledger Creation (Interest Paid)

Note : Open Credit Note Voucher and Press CTRL + H to change Voucher Mode –

Select Party Account

Credit Note will be like some thing this

Balance Sheet After Credit Note You will be showed interest amount added into part account and your Liabilities will be Increased.

Payment Voucher

Make Full Payment Voucher Against bill No and Credit note

Payment Voucher

Sales Voucher-

Required Following Ledger

- Party A/c under Sundry Debtor

- Sales A/c under Sales Accounts

- Interest Received under Indirect Income

Voucher Entries

- 1 July-25 Sold 1 LAPTOP to Rahul Kumar @53200 on credit 15 days

- 31 July-25 10% Interest Yearly

- Make Full Payment

Assignments

Assignment 1: Interest on Customer Outstanding

- Party: Ravi Traders (Debtor)

- Interest Rate: 15% per annum

- Invoice Date: 01-Apr-2025

- Invoice Amount: ₹50,000

- Credit Period: 30 days

- Payment Not Received till 31-May-2025

Tasks:

- Enable interest calculation with advanced parameters

- Create Ravi Traders ledger under Sundry Debtors

- Set up 15% interest from due date

- Pass a sales invoice of ₹50,000

- View interest due in Interest Calculation Report

Assignment 2: Interest on Loan Payable

- Party: ABC Finance (Creditor)

- Loan Taken: ₹1,00,000 on 1-Jan-2025

- Interest Rate: 10% p.a.

- Interest Type: Simple

- Payment Not Made till 31-Mar-2025

Tasks:

- Create ABC Finance ledger under Sundry Creditors

- Enable simple interest @10%

- Pass a journal entry for loan received

- Check interest payable on 31-Mar-2025 in report

TallyPrime simplifies the process of Simple Interest Calculation, saving time and reducing errors. Whether you’re tracking loans, delayed payments, or investments, the feature helps you manage your finances effectively. Follow the step-by-step guide above to start calculating interest in TallyPrime effortlessly.