A business transaction refers to any activity that involves the financial exchange of money or goods between two or more parties. It can involve the exchange of goods, services, or money.

A business transaction is “The movement of money and money’s worth form one party to another”. Or exchange of values between two parties is also known as “Business Transaction”.

Key Characteristics of Business Transactions:

- Money Involved: Money or money’s worth must be exchanged.

- Impact on Financial Records: Each transaction will affect at least two accounts in the accounting system (one will be debited and the other will be credited).

- Documented Evidence: Business transactions are usually supported by documents like invoices, receipts, purchase orders, etc.

- Cash transaction

- Credit transaction

1. Cash Transactions

These are transactions where payment is made immediately at the time of the transaction, Cash transaction is a exchange for goods and service immediately paid.

Example:

- You purchase office stationery for ₹500 and pay the amount in cash.

- You sell a product and receive cash of ₹1,000 immediately.

2. Credit Transactions

These transactions occur when payment is made at a later date. Here, the buyer receives goods or services now and agrees to pay in the future. Credit transaction is a exchange for goods and services and paid in future.

Example:

- You purchase raw materials worth ₹10,000 from a supplier, but you agree to pay the supplier in 30 days.

- You sell goods to a customer for ₹5,000 and they promise to pay you within a week.

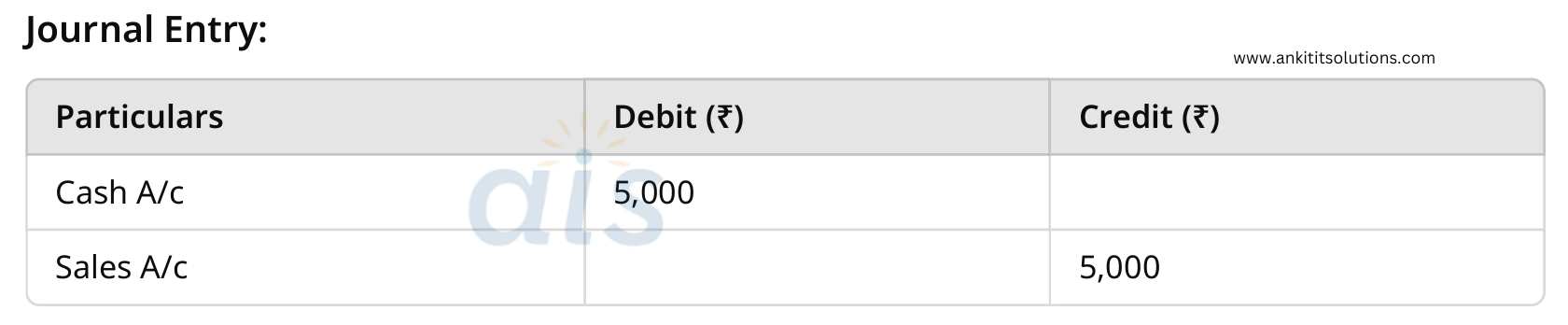

Example 1: Cash Sale

Transaction: Sold goods for ₹5,000 and received payment in cash.

- Sales Account (Nominal Account)

- Cash Account (Real Account)

Explanation:

- Cash is coming into the business, so the Cash A/c is debited.

- The income from sales is earned, so the Sales A/c is credited.

Example 2: Credit Purchase

Transaction: Purchased raw materials worth ₹12,000 from a supplier on credit.

- Purchases Account (Nominal Account)

- Accounts Payable (Personal Account)

Explanation:

- Since raw materials are coming into the business, the Purchases A/c is debited.

- The amount is due to the supplier, so the Accounts Payable A/c is credited.

Example 3: Credit Sale

Transaction: Sold goods for ₹8,000 on credit to a customer.

Accounts Involved:

- Accounts Receivable (Personal Account)

- Sales Account (Nominal Account

Explanation:

- Since goods are sold on credit, the Accounts Receivable A/c is debited.

- The income from sales is credited to the Sales A/c.

By following the simple steps of identifying accounts, applying the Golden Rules, and using journal entries, you can efficiently record all your business transactions.